Background

About the client

A leading European private equity firm managing multiple strategies across several geographies, focused on supporting mid-market companies through transformational growth.

Context

The firm was facing mounting inbound queries from its investors. As a fast-growing firm raising multiple strategies at once, the IR was under unsustainable pressure.

With no centralized source of truth and rising expectations from LPs, the firm turned to Holland Mountain to deploy technology to scale and digitalize their processes in order to scale.

The Challenge

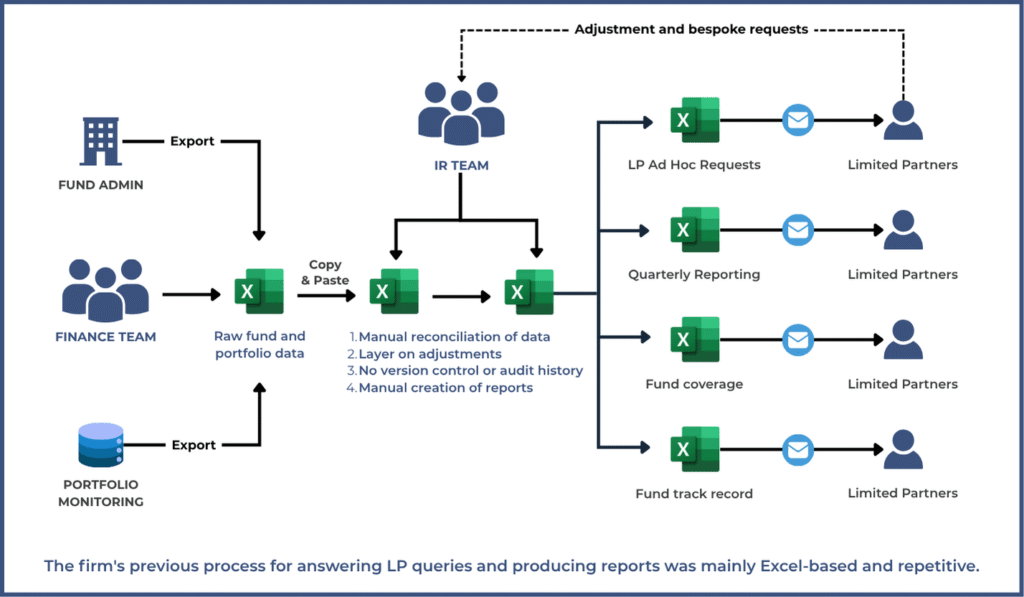

Outdated processes were holding the IR team, and the firm, back. The firm’s Investor Relations team was operating without a unified view of fund and portfolio data, causing two main problems.

1. Manual effort led to slow LP response times

For each LP question – about exposure to a specific sector or the performance of a particular fund – it required a manual data exercise by the IR team.

- Data had to be gathered, reconciled, and analyzed across multiple spreadsheets and sources.

This process routinely took days or even weeks, severely limiting responsiveness.

2. Operational bottlenecks are putting fundraising and growth at risk

The firm was actively growing, launching new funds, and attracting more LPs.

- LPs were often invested across multiple funds, increasing the complexity of queries.

- A rising volume of questions was driven by a challenging economic environment and LP scrutiny.

The IR team was stretched thin. Scaling the firm’s investor servicing capacity required a fundamental data infrastructure shift.

The Solution

Streamlining investor servicing with the right data platform

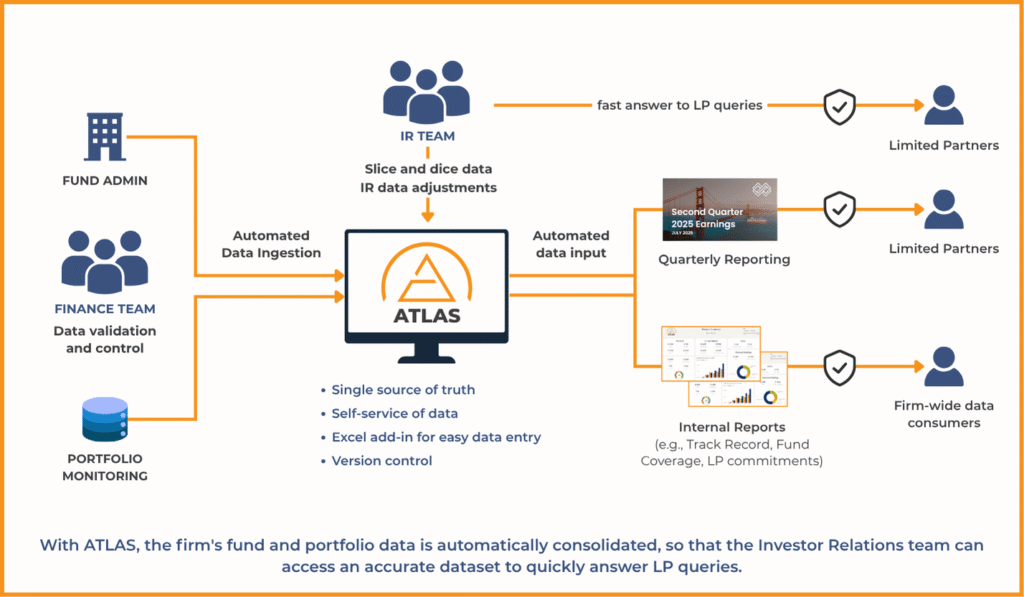

To address the challenge, Holland Mountain deployed ATLAS Track Record.

ATLAS provided a scalable architecture to streamline investor reporting and query response.

Key capabilities implemented:

- Data ingestion from both the fund administrator and the portfolio monitoring system.

- Automated data reconciliation of fund and portfolio monitoring data

- Automated generation of investor and internal reports.

- Dashboards enabling the IR team to slice and dice data to answer any question on demand.

- Excel export functionality for users who prefer offline modelling or manual follow-up.

This solution transformed how the IR team accessed and used data across the LP lifecycle.

Outcome

With ATLAS in place, the firm’s IR team gained access to accurate, up-to-date, and reconciled data. The same IR team was able to scale its support without additional headcount.

“We have access to all the data we need to be able to answer questions, almost instantly. We’ve saved more time than we thought was possible.”

Head of Investor Servicing, Large European GP.

1. Vast improvements in IR efficiency

LP questions can now be answered instantly, not in days or weeks.

Internally, the IR team can quickly extract key data before fundraising meetings, such as:

- Investor-specific data.

- Fund-level data.

- Portfolio-level data.

The team can drill down by region, sector, fund, or investor – on demand.

2. Enablement of fundraising strategies for strategic growth and fundraising

Overall, IR teams are now able to focus on value-add tasks, rather than reconciling data.. The firm was able to have:

- Faster, sharper fundraising conversations.

- Higher-quality service for investors.

- The IR team is able to focus on engaging with LPs.

Ready to upgrade how you support LPs and raise funds?

The leading firms use Holland Mountain’s ATLAS Track Record to give fundraising and investor servicing teams access to the data they need in real time.

Our ATLAS solution is:

- Implemented in 2 to 3 months.

- Purpose-built for fundraising and investor servicing.

- Designed for scaling without adding headcount.

Discover ATLAS Track Record and schedule a demo with our team to see it in action.