Model Context Protocol is gaining traction and fundamentally changing what AI can accomplish for finance teams. LLMs can now interact directly with enterprise systems, understanding data schemas, semantic relationships, and system architectures in ways that extend well beyond chatbots.

While the deal and investor relations teams have captured most of the attention in AI adoption over the past few years, finance teams are now positioned to realize comparable gains.

Their naturally structured data environments were always strong candidates for AI applications; what has changed is the technology’s ability to work within these systems rather than simply alongside them.

At Holland Mountain, we regularly encounter finance leaders among our clients who recognize this inflection point but require clarity on which applications warrant immediate attention versus longer-term consideration. Below are practical quick wins delivering value today, alongside emerging capabilities that are nascent but hold significant potential once they mature.

Low-handing fruits: immediate value for Finance teams

1. Excel add-ins

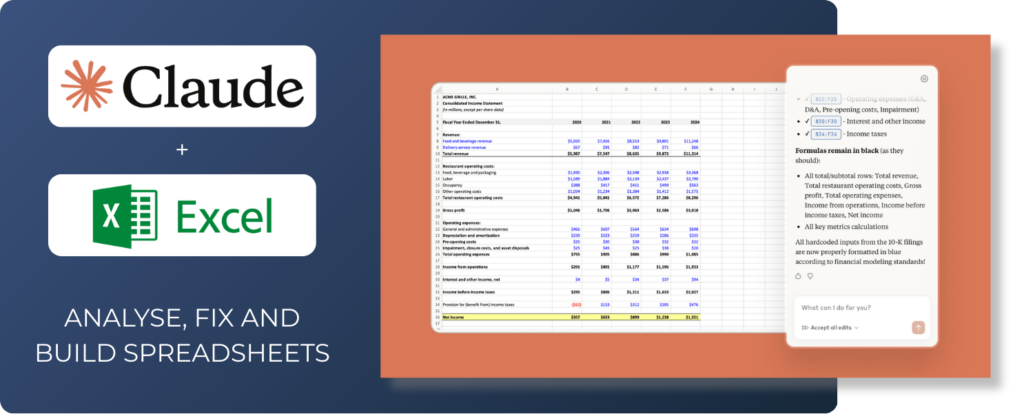

Excel add-ins with AI capability have proliferated rapidly, and we recommend finance teams evaluate options suited to their workflows.

Claude in Excel particularly demonstrates strong functionality through direct spreadsheet control rather than formula assistance alone.

- Claude operates within Excel’s architecture, populating cells across multiple ranges, building financial models from natural-language prompts, and diagnosing errors in existing workbooks.

- For example, professionals can prompt “create a valuation model for a tech SaaS business” and receive a structured DCF analysis built directly in the spreadsheet, complete with formatting, formula logic, and sensitivity tables.

This differs from tools that merely suggest formulas. The model writes directly into the workbook, accelerating manual construction tasks while preserving flexibility for customization.

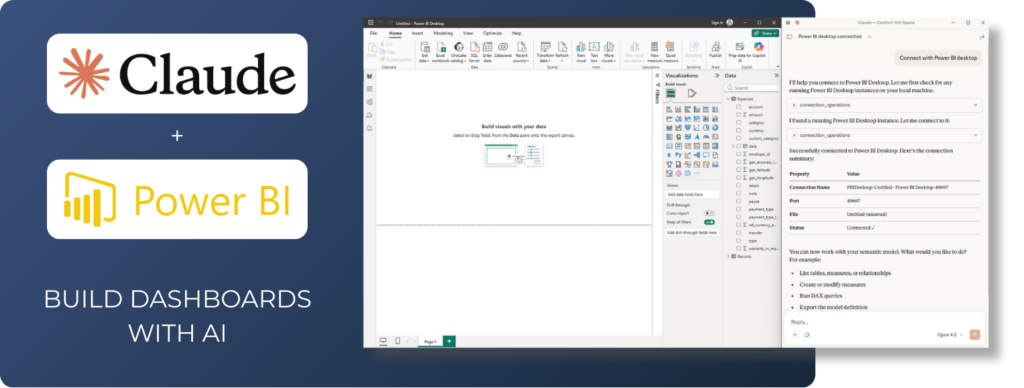

2. MCP for Business Intelligence Tools

MCP servers (which act like APIs for AI tools) now enable direct integration between AI systems and business intelligence platforms such as Power BI and Tableau.

This connectivity provides two meaningful advantages over traditional workflow approaches:

- AI accesses the complete data model – tables, schema definitions, and relational structures – enabling contextually appropriate queries and analysis rather than surface-level interpretation

- Results are written directly into reports and dashboards, eliminating manual transfer steps (copy-pasting) that can introduce errors and consume time

A practical application: prompting Claude to construct an IRR calculation within Power BI.

MCP connections extend beyond BI tools to CRM platforms, document repositories like SharePoint, and other enterprise systems where finance teams require AI assistance with structured data analysis.

3. Meeting Note-Takers

An obvious application, but one worth emphasizing given its relevance to busy finance teams.

Finance teams conduct substantial meeting volume – internal planning sessions, auditor discussions, fund administrator reviews, tax advisor consultations – and AI-powered transcription tools provide an efficient method to capture key points, ensure information is saved, and enable future reuse of critical details from these conversations.

We recommend that finance teams evaluate available options in this category.

Going Deeper: Specific Finance Tasks

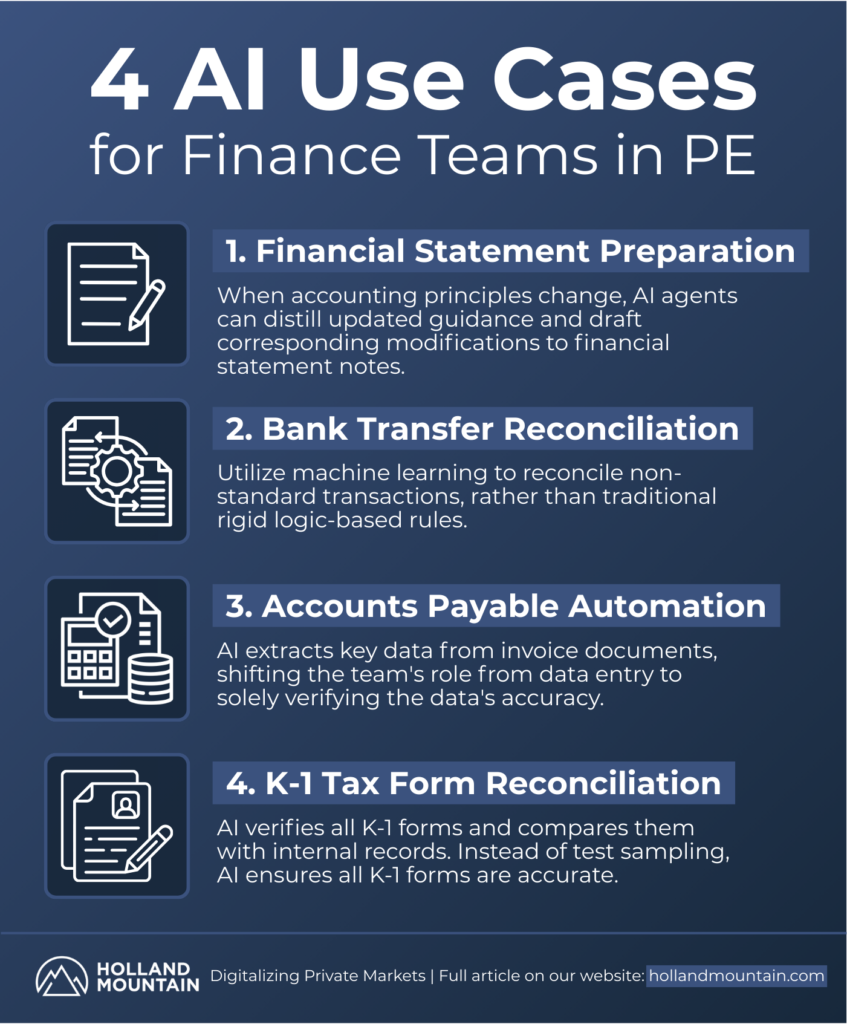

1. AI for Financial Statement Preparation

Specialized AI agents trained for finance workflows represent an emerging category, with multiple services connecting to data sources to accelerate information retrieval.

A concrete application involves financial statement preparation:

- When accounting principles change, AI agents can distill updated GAAP guidance and draft corresponding modifications to financial statement notes

- These tools connect to various document sources – contracts, limited partnership agreements, industry guidance, accounting standards – to extract relevant information

The market is developing rapidly with new tools appearing regularly. Finance teams should evaluate solutions against their specific requirements as capabilities and reliability vary across providers.

2. Bank Transfer Reconciliation

AI-enabled bank reconciliation represents an edge use case with significant potential, though solutions remain nascent.

- Traditional reconciliation tools operate on rigid rule-based logic – matching exact names between systems.

- Machine learning introduces adaptive capability by observing how finance staff manually reconcile non-standard transactions and replicating those patterns systematically rather than following predetermined rules.

This becomes economically viable where high transaction volumes justify upfront investment. Solutions remain early-stage.

We recommend that finance teams monitor development rather than pursue immediate implementation, particularly when transaction volumes may not warrant the required investment.

3. Accounts Payable Automation

AI-enabled invoice processing has matured considerably, with many accounts payable platforms now incorporating these capabilities as standard functionality.

Traditional workflow required manual invoice review to extract key parameters – invoice date, amount, entity, VAT number. AI now performs this extraction automatically to a highly accurate level:

- The system identifies and populates data fields directly from invoice documents

- Human oversight remains valuable, but shifts from data entry to verification, with the AI highlighting within the document where each field was extracted.

This approach increases control levels rather than eliminating review entirely, making the validation process substantially more efficient.

4. K-1 Tax Form Reconciliation

Finance teams typically engage external tax advisors to prepare K-1 forms for LPs, then conduct sample-based verification to confirm accuracy – spot-checking a subset of forms for correct LP details and allocations.

AI allows finance teams to test all forms, rather than sampling:

- The system processes all K-1 forms prepared by tax advisors, extracting relevant data fields automatically

- Extracted information is compared against internal records, identifying discrepancies across the complete population rather than a limited sample

This approach parallels the accounts payable application, shifting verification from partial coverage to comprehensive review.

Moving Forward

More specialized tools arrive in the market regularly, and MCP connectivity will accelerate adoption across finance workflows. The technology has matured sufficiently to warrant active evaluation rather than passive monitoring.

As with any AI implementation, underlying data quality remains essential. Clean, well-structured data environments enable large language models to function effectively.

This is an area where Holland Mountain’s ATLAS Data Platform provides foundational capabilities, enabling finance teams to access AI tools within data environments that meet the structural and quality requirements these systems demand.

If you want to know how AI can be applied to your team and existing workflows, speak to our AI experts for an in-depth discussion.