“How confident are we in the accuracy of the data within our reports?”

“Are we able to find the data we need fast and trust that it’s right?”

These are the types of portfolio monitoring-related questions we consistently receive across the industry, regardless of the firm size. No one wants to deal with the cost, distraction, and risk of inaccurate reporting.

And we know that for the larger GPs, this challenge becomes significantly more acute.

As investment strategies become more complex and tech stacks continue to grow, getting this right protects both reputation and operational efficiency.

To stay ahead of this challenge, we recommend clients review four key areas to strengthen controls and governance across portfolio monitoring:

1. Technology Infrastructure

Portfolio monitoring systems are the natural starting point. Your platform must meet functional needs and remain operationally sound – regular health checks and targeted upgrades prevent issues from compounding at scale.

Key technology requirements include:

- Artificial intelligence (trusted data capture + automated reconciliation) – high-accuracy extraction with validation you can rely on, plus automated cross-checks across submissions, source systems, and supporting documentation.

- Clear sources of truth – fit-for-purpose tools for each data type (e.g., cap tables in specialist systems, not spreadsheets)

- Strong integration capability – reliable connectivity to internal and third-party sources (e.g., ERP, bank data, FX feeds, market data)

- Interrogation + segmentation – easy drill-down by scenario, “as of” dates, and event timelines (e.g., pre-/post-M&A)

- Built-in data quality controls – required fields, submission gating, and exception alerts to prevent gaps

- Effortless reporting – stakeholder-ready outputs without spreadsheet workarounds or missed exceptions

Without these capabilities, teams revert to manual processes and spreadsheets – limiting the governance and consistency that strong monitoring requires.

2. Team Structure and Accountability

Technology alone can’t guarantee data integrity – strong outcomes depend on clear ownership and disciplined execution. We consistently see the following team factors drive success:

- Clear accountability and role ownership across the monitoring process

- Appropriate team sizing with identified capability gaps addressed proactively

- Incentive structures that reinforce desired behaviors around data accuracy

- Routine validation checkpoints (e.g., weekly reconciliations, consistency reviews)

- Strong training and knowledge transfer to avoid key-person risk as teams evolve

Measuring data quality operationally

More mature firms treat data quality as a performance metric, tracking indicators such as on-time submission rates, validation failures by company/period, time-to-resolution for flagged issues, frequency of restatements, and days-to-close for the reporting cycle. This creates accountability and drives continuous improvement in portfolio monitoring governance.

3. Effective Portfolio Company Onboarding

Onboarding sets the control environment. The most effective approach is to standardize the “data contract” with portfolio companies before data collection begins.

Key components include:

- A single KPI dictionary (e.g., ARR, EBITDA adjustments, cash definitions)

- Standard monthly/quarterly reporting templates

- Clear cutoffs and reporting calendars

Structured reconciliation between submissions and supporting documentation, e.g., board packs and management accounts

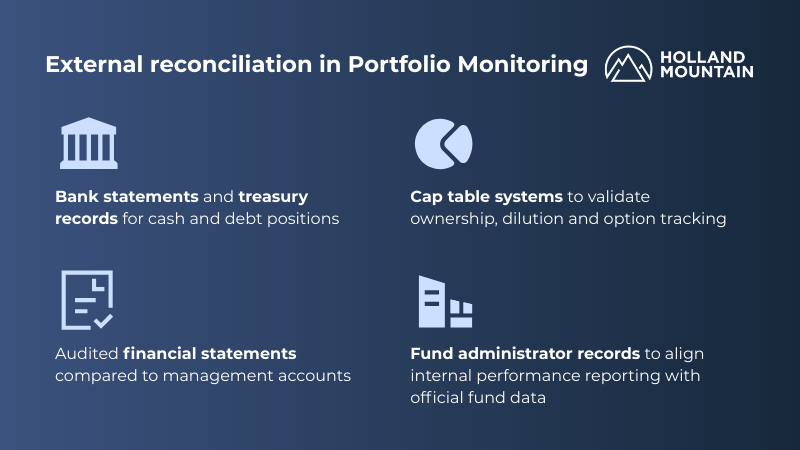

External reconciliation as a differentiator

External reconciliation represents a significant opportunity to ensure quality data, by validating data against multiple independent sources.

This multi-source validation prevents internal numbers from appearing accurate while failing to tie to external reality.

4. Defined approach for managing complexities

Mergers and acquisitions activities

M&A activity requires particular attention to ensure transactions are captured and reflected appropriately across affected metrics. One-off adjustments – whether for extraordinary events, accounting reclassifications, or operational exceptions – demand systematic documentation and tracking to maintain audit trail integrity.

M&A activity puts portfolio monitoring under the most pressure – metrics shift, definitions change, and “one-off” adjustments start to pile up. The only way to stay in control is to treat transactions and adjustments with disciplined documentation and traceability.

This includes systematic tracking of:

- Pre-/post-close performance bridges (so trends remain interpretable)

- Pro-forma vs. reported views (so stakeholders aren’t mixing narratives)

- One-off adjustments (extraordinary items, reclassifications, operational exceptions)

- Explicit audit trails showing what changed, when, and why

Restatement management

Restatements aren’t a sign of failure – they’re inevitable as companies mature, implement ERPs, or incorporate audit outcomes. The risk is allowing restatements to occur informally, which quickly erodes confidence in dashboards and board reporting.

A robust restatement protocol should capture:

- Original submission (what was reported)

- Corrected submission (what changed)

- Clear rationale and supporting evidence

- Impacted periods, KPIs, and downstream reports

- Whether LP reporting requires an amendment

Done well, this preserves data lineage and allows teams to understand how metrics evolved over time – protecting trend analysis, decision-making, and credibility with LPs.

Unsure where to begin?

Tackling all these areas at once can be too overwhelming. We work extensively with large GPs navigating these challenges and can guide prioritization based on your specific circumstances. The most impactful interventions vary by organizational context, existing infrastructure, and growth trajectory.

Our approach emphasizes understanding how industry best practices translate to your particular situation and establishing frameworks that maintain control as you scale while addressing evolving regulatory requirements.

We are happy to discuss your specific environment and how to strategically strengthen your data governance posture. Contact us today.