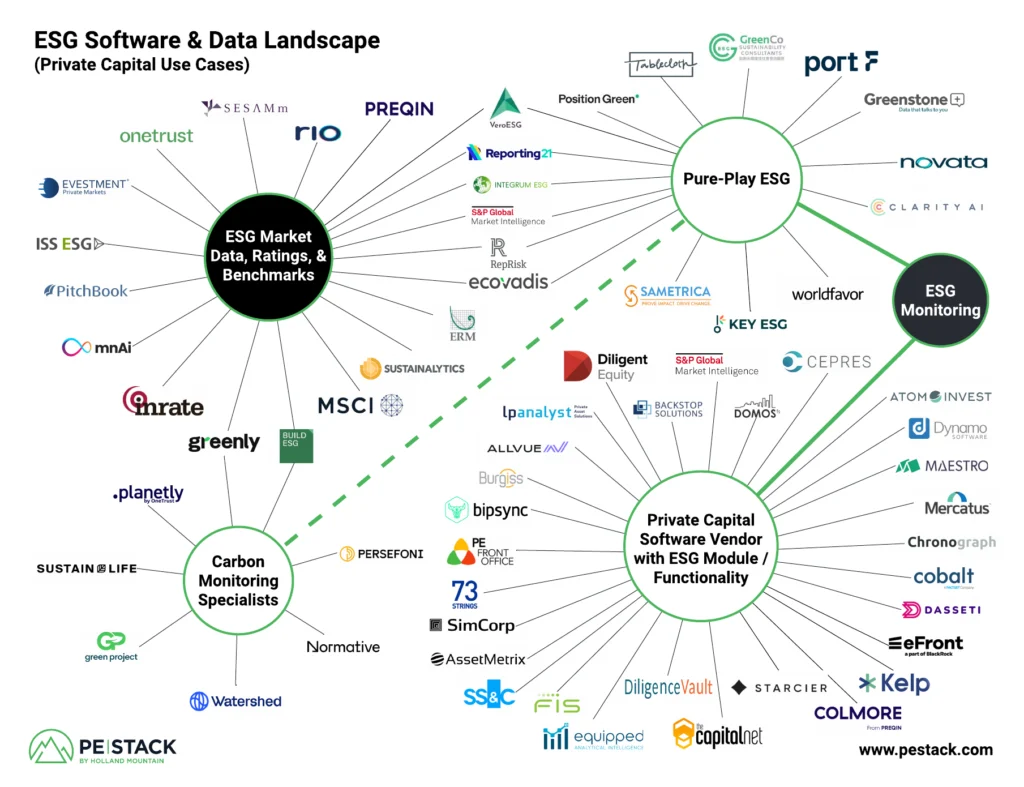

Producing a map that provides a meaningful overview of ESG data and software providers actively used by private equity, venture capital, and other private capital firms is especially challenging for the following reasons:

-

The emergence of many new platforms and modules in recent years

-

Determining relevance for private capital use cases

-

Delineating between service providers and software/data vendors

-

Grey areas in terms of what constitutes true ESG capability for more generalist private equity and broader private capital data and software providers

-

Determining the right level of granularity for product categorization

As a result, we made a few tough decisions in putting this one together and will likely revise and add to this map as this exciting area of the market continues to develop:

-

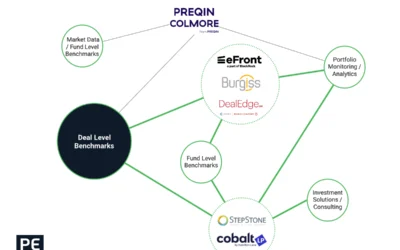

We appreciate that there are some significant differences between products covering ratings, market data, and benchmarks. In future editions, we may split this area of the market into a separate map to provide more insight into the different use cases.

-

We intentionally limit the map to show vendors offering subscription products available to the market as standalone products only. That results in some decent quality offerings, especially on the fund administration side, from being included where access to products is predicated on a service provider relationship.

-

We decided to highlight carbon monitoring/accounting solutions as a separate sub-category given the quite specific demands of this area and the frequency with which we see solutions sought out to solve this requirement. Please note that many other monitoring solutions have competent carbon functionality, and certain solutions in our carbon specialization grouping will also solve wider ESG requirements.

As ever, our goal is to maintain comprehensive intelligence on relevant vendors in the private capital arena. If you feel we are mistakenly excluding or miscategorizing vendors, we’d love to hear from you. If you are a GP or LP seeking help in identifying the right data and technology, let’s talk!