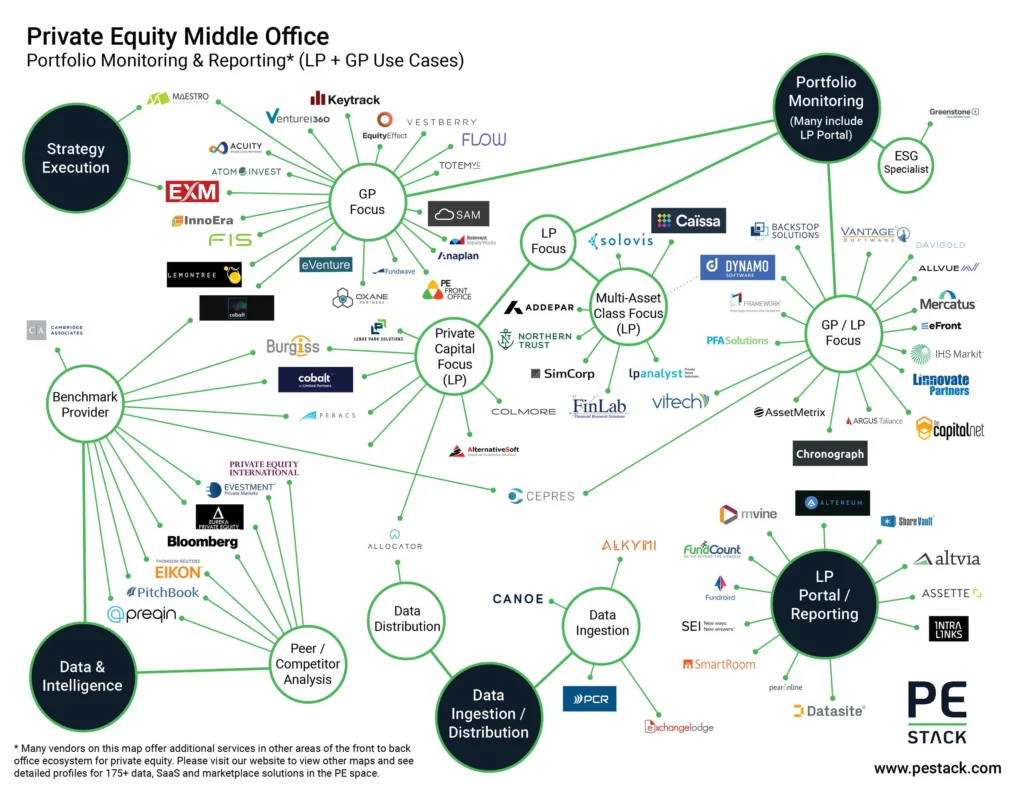

Private Equity Portfolio Management

Excel’s reign as the king of middle office has finally come to an end. The explosive growth of the industry, both in terms of size and complexity, has fueled the rise of sophisticated portfolio monitoring and reporting tools for both LP and GP use cases. In today’s highly competitive and socially distanced world, adopting the right solution carries great importance for LPs & GPs. A good middle office solution will help investors manage their data effortlessly, analyze portco and fund performance effectively, and streamline LP reporting.

We’ve split our representation of this area to show vendors servicing GP and LP use cases, with further granularity around private capital and multi-asset class focus for LPs. We’re also showing data vendors commonly used for benchmarking existing portfolio performance and conducting peer analysis. We’ve tried to exclude data providers which utilize partnerships with vendors on this map rather than maintain a proprietary source of fund performance, benchmark and manager data.

Many portfolio monitoring tools will feature integrated LP portals, we also attempt to show some of the prominent names in the data room space with standalone products, although in some cases (notably Altvia) these vendors have additional products/modules for areas outside of middle office which feature on our other industry maps. An important aspect of the middle office is managing the flow of data, and we cover some of the key players focusing on this specifically.. Many feature integrations with portfolio monitoring solutions, we track such relationships on our vendor profiles platform.

We tend to exclude more generic tools when we create these maps, but we do include some mainstream providers due to their prominence in the space, such as Anaplan. We also see applications such as PowerBI being used in this area and work with consultants which specialize in setting up such tools for private equity use cases when our client projects demand.

Portfolio Monitoring:

Portfolio monitoring tools collect data from portfolio companies, provide a monitoring dashboard and KPI analytics tools and streamline ongoing LP reporting. Many firms suffer from data fragmentation and inconsistency, so a compelling benefit of portfolio monitoring solutions is the single-source-of-truth data layer that combines data collection, validation, and audit trails. Having all the data on a single platform helps investment teams analyze portfolio and fund performance accurately and consistently, with the help of built-in real-time analysis tools. Moreover, users can easily generate adhoc and automate ongoing LP reports through pre-populated, customizable templates. On the LP side, these solutions offer additional tools such as exposure, liquidity and risk analysis for multi asset class portfolios. All in all, portfolio monitoring solutions help investors spend less time on data collection while ensuring its validity, see portfolio and fund performance more holistically, and improve investor relations.

Data Ingestion / Distribution:

Document automation and data ingestion platforms eliminate manual data entry processes by extracting data from unstructured documents and applying machine learning (ML), natural language processing (NLP) and computer vision technology to structure and process it. The AI engines learn the patterns in documents, enabling the automated extraction of vital data across different document types to whatever the destination database requires. Other products in this space exist to bring efficiency and normalization to the process of collecting or distributing data, typically for the LP use case (e.g. Allocator).

Strategy Execution:

Strategy execution platforms allow funds to consolidate all investment and PortCo value creation strategies, quantitative and qualitative, on a single platform for firm-wide alignment and tracking. Too many firms are sitting on an unexplored goldmine of valuable proprietary data. Strategy execution platforms allow users to not only track qualitative tasks assigned to quantitative goals, but also over time, analyze the effectiveness of actions and strategies employed to reach the end goals. This can be especially useful for investors that are sector-focused, since they can use actionable data from their existing PortCos’ strategies for effective due diligence in addition to helping PortCos embrace proven best practices.

LP Portals:

Virtual data rooms provide a secure document sharing platform between GPs and LPs, used mostly for fundraising and delivery of ongoing performance reporting. It is increasingly common to see such tools include analytics and value-add features to enhance the LP experience. The ability to brand the portal with a client’s logos and colors is also a common feature. Data rooms are often incorporated into portfolio monitoring solutions, the bubble on our map represents some key vendors that offer a standalone module.

Data Providers – Benchmarking & Peer Comparison

We cover data providers more extensively in our Front Office Map where there are more use cases to consider. Here we cover providers used to help LPs understand the relative performance of funds in their portfolio against benchmarks, and those which provide intelligence on peer firms and funds. We have tried to exclude data providers which provide this intelligence via data partnerships and do not maintain a proprietary database.

Thinking about procurement? We can help.

The middle office space is vastly complex. The varying asset classes, fund structures and unique workflows of GPs and LPs allow many solutions to thrive, but also makes it harder to find the right fit. Through our detailed vendor profiles database and free procurement service, we help private equity and venture capital investors understand the different solutions in the space and confidently assess them to find the best fit. If you’d like to learn more, please leave your details below and we’ll be in touch.