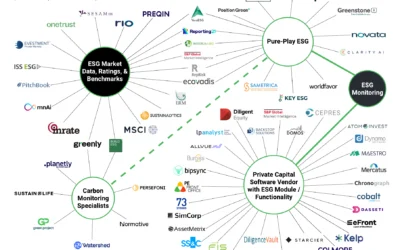

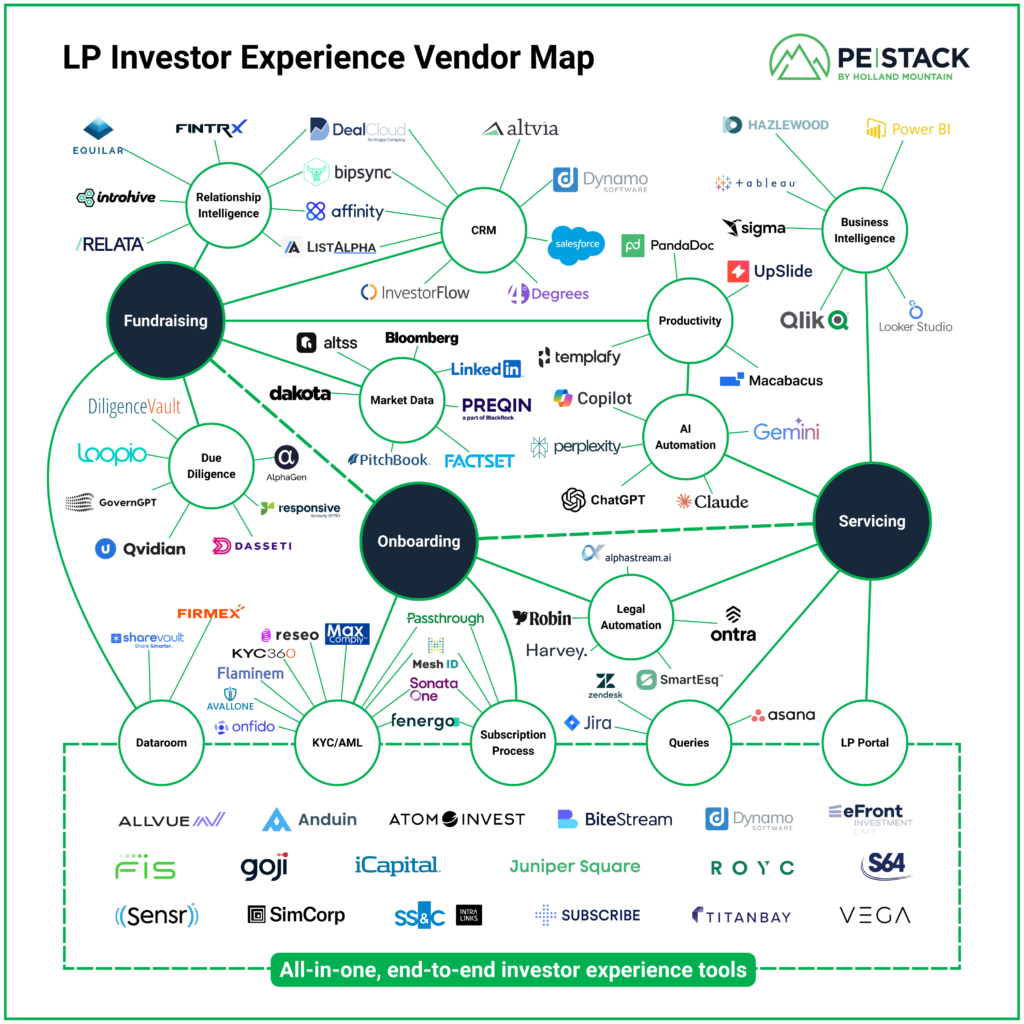

Download this map in high-resolution PDF >>

Defining use cases and relevant vendors for the fast-moving topic of Investor Experience is challenging. While we do have criteria in place to determine positioning on the map, any omissions are likely unintentional ,and we encourage you to contact info@pestack.com and erica.shery@hollandmountain.com in order to request any changes or additions to the map.

Investor experience in private equity: Executive summary

Improving the investor experience has become an increasingly key theme in client discussions around technology and operational strategy.

Encouragingly, the vendor landscape for investor experience tools is now proven and finally delivers the right tooling that GPs – and particularly IR teams – have been asking for all along.

Specifically, we see:

- Relationship intelligence is becoming essential to stay on top of a growing LP base and make better decisions to support fundraising.

- DDQ tools are providing the efficiency needed to stop repeating content creation for each LP.

- Onboarding tools are making the process as painless as possible for both GPs and LPs by providing a guided journey where everything happens in one place.

- Query management tools enable GPs to centralise all LP queries and stay consistent in their answers at scale.

- LP portals offering a single place for LPs to login throughout the fund lifecycle, with the ability to tailor the experience based on individual preferences.

Additionally, we are seeing all-in-one investor experience tools becoming a preferred choice for GPs, complemented by specialist tools to support non-investor-facing functions.

Holland Mountain’s PE Stack has created this map – featuring over 75 vendors – to show the breadth of the investor experience landscape now available to the private capital industry.

It’s important for private equity firms to act now: design a modern investor experience tech stack, and implement scalable processes to provide an end-to-end experience to investors (all things we can help with, please contact

Doing so will ensure firms stay ahead of rising LP expectations in 2026 and are ready to effectively service the increased volume of investors entering through new channels.

Fundraising

CRM, relationship intelligence, and market data

Without a doubt, CRM remains the central platform for tracking LP relationships and fundraising progress.

What’s new, however, is that relationship intelligence is becoming increasingly important. GPs can map out who knows who, the strength of relationships, and the coverage across their team, then use automations in CRM to stay on top of their entire LP base.

Additionally, we are seeing AI now embedded in this process. AI automations in CRM are helping teams be more efficient – summarising meeting notes, filtering market data – and staying on top of relationships.

Integrating market data remains key during fundraising, enhancing the prospecting phase and strengthening the overall view of the relationship landscape.

DDQs and data rooms

The major new advantage when it comes to DDQs is operational efficiency. Teams have historically been spending too much time producing answers to DDQs, often recreating content that already exists across reporting, previous submissions, or other internal data sources.

- New tools can access structured and unstructured data – from CRM records, reports, databases and emails – to help generate accurate and consistent responses more efficiently.

- AI can support this process by identifying relevant information from across systems and proposing draft responses, reducing manual effort and duplication.

Data rooms, meanwhile, provide an engaging way for LPs to access information and review supporting documents. By analysing insights from data room activity, GPs can identify what actually matters to investors and focus on providing the most relevant, high-quality answers rather than volume.

Onboarding

There’s been a lot of positive change in this category. In the past, onboarding involved multiple fragmented systems. Today, new tools are making the process as seamless as possible for users on both sides.

The goal is to collect documents from LPs in the most efficient way, allowing them to reuse previous answers and documents, and to receive instant feedback to reduce back and forth. All documents can then be monitored in one place, with automated alerts when updates or refreshes are required, removing the need for manual tracking.

Another key benefit is that all discussions, legal reviews, and stakeholder comments happen within a single environment, enabling faster collaboration and greater transparency.

Specialist tools continue to play a key role, particularly in compliance. They automate background checks, track document status, and manage complex verification steps that previously required significant manual effort.

This is helping firms deliver a smoother, faster, and more efficient investor onboarding experience.

Servicing

Queries

Managing investor queries has historically been a fragmented process, with questions coming through multiple channels — tax, fund administration, finance, investor relations, and other support functions. Emails flow into different mailboxes across the business and external partners, often resulting in inconsistent responses.

With the right tools, firms can now bring all these interactions together into a single view, tracking every touchpoint with investors.

This allows teams to monitor query type, duration, and resolution, and to reference how similar questions were answered previously. The outcome is greater efficiency and, most importantly, a consistent, high-quality response experience for investors across all communication channels.

LP Portals & other servicing tools

The focus of servicing tools is to provide a high-quality investor experience throughout the entire life of the fund.

When it comes to LP portals, firms are moving beyond static reporting to deliver interactive content and dashboards that allow LPs to explore data, slice and dice results, and access information in the right format.

It’s also about broadening engagement, using videos, presentations, or other media to communicate in more dynamic ways and build stronger relationships.

Importantly, the experience now must be tailored to different LP types.

- Larger LPs may prefer one-click data exports to feed directly into their own systems.

- Smaller LPs like retail or private wealth investors value a richer, more interactive portal experience.

Segmentation, now possible with the right tools, enables GPs to deliver a white-glove service for every investor profile and adapt to expectations.

All-in-one tools

All-in-one tools are a growing trend – something that would have been rare just a few years ago. What’s particularly interesting is where these tools have come from.

- Some were originally pure fund accounting tools

- Some began as point solutions for one element of the investor experience

- Others began in adjacent sectors such as banking or private wealth, designed to handle a high volume of investors.

- And a few have been built more recently with the specific goal of being all-in-one solutions.

There’s a clear rebuilding happening, as vendors recognise the need to provide a seamless, all-in-one experience – covering everything from the data room through to onboarding, servicing, and reporting.

Conclusion: What Can We Expect for 2026?

Looking ahead, AI will play a much larger role in the investor experience. We can expect to see more AI-driven tooling on the investor-facing side, helping firms respond faster, personalise communication, and surface insights automatically.

Structured documents will continue to be the standard for now, even though the idea of a live data feed remains appealing. The key question is how long the industry will stay in a structured document world before shifting toward more dynamic, data-led formats.

LP expectations are also changing. They will increasingly look for an all-in-one experience, with fewer platforms to log in to and smoother, more integrated workflows.

To meet this demand – especially with the growth of private wealth participation – firms will need to modernise their systems and design investor journeys that can scale efficiently across a broader investor base.