For most firms, fundraising has stopped being seasonal and has become constant, all year round. Meanwhile, the volume and complexity of LP requests continue to rise.

In this environment, IR teams must spend less time wrangling data and more time on the value-added tasks that set their firm apart.

At Holland Mountain, we see growing demand to streamline processes and deploy technology that enables IR teams to scale. This article outlines the common industry challenges, the trends shaping IR operations, and strategic recommendations for adapting to this new reality.

Why Traditional IR Processes Are Reaching Their Limits

When working with our clients, we repeatedly encounter the same internal roadblocks:

- No self-service data: IR teams rely heavily on other departments to access the data they need. The way other teams report on data often doesn’t align with how IR needs to present it, forcing IR to keep their own copies.

- Manual reconciliation: Because of these misalignments, IR teams manually reconcile data from multiple sources – often in Excel. This process is not only time-consuming but also prone to errors.

- Repetition of effort: Each time a fundraising or LP query comes in, teams repeat the same tasks – manually pulling, formatting, and adjusting data – leading to duplicated work and slower response times.

- Lack of scalability: As investor queries and bespoke LP templates multiply, manual processes become overwhelmed, and IR ends up doing low-value tasks instead of selling.

What worked when raising a single fund breaks down when fundraising is perpetual across multiple strategies.

Throwing more people at spreadsheets no longer solves the problem – so how are leading firms fixing it?

The Fix: Build a Single Source of Truth, Then Automate

Leading GPs are increasingly implementing data platforms as a solution for the IR team, which allows the consolidation of data and the automation of low-value tasks.

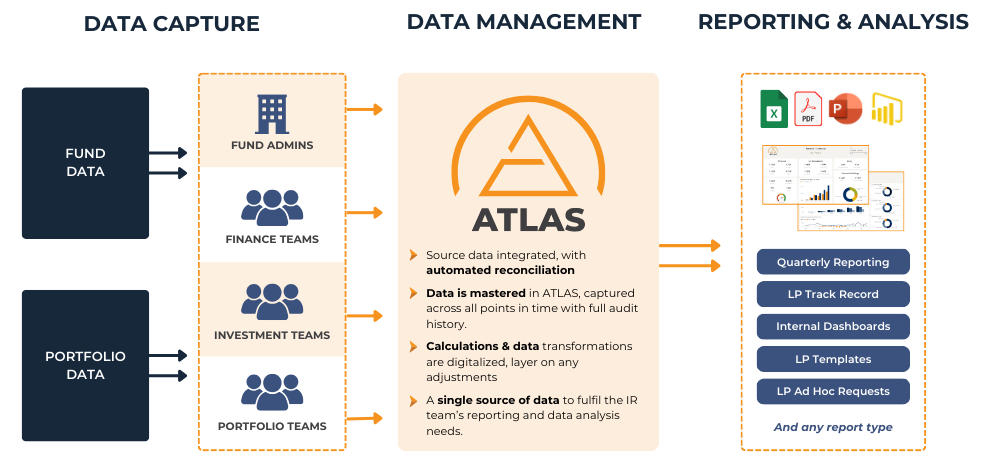

Data Platform for IR operations

Example of how a data platform connects and reconciles data from systems, service providers, and feeds, providing a single source of truth to feed any reporting & BI dashboards.

An enterprise data platform contributes to the IR team’s scalability through:

1. Capture data automatically and with controls

No more manual gathering of the data. A data platform automatically pulls data from internal sources (CRM, accounting systems, portals) and external sources (fund admins, benchmarks, market data) through integrations.

At the same time, firms can establish the appropriate governance with sign-off and oversight tools that are built into the data platform. Data ownership can then be formalized across finance, fund administration, and investment teams to ensure accuracy at the source.

2. Enrich and adjust data easily before reporting

IR teams can enrich all the data they need with attribute information such as investor type and fund strategy directly from the data platform. IR teams can also layer in their adjustments when required to effectively report on performance data.

3. Flexible reporting and dashboards

As a result, high-quality performance data flows into reporting and visualization tools (e.g., Power BI, Tableau), where IR teams can dynamically slice and dice data to access the information they need.

Simply put, it means that IR teams can efficiently oversee the output – quarterly reporting, ad hoc queries, and data room management, etc. – and benefit from push-button reporting to gain time.

These efficiency gains allow IR professionals to spend more time on value-added activities, like crafting the narrative of the firm to investors.

Five Ways a Data Platform Supports an Investor Relations Team

1. Enables self-service of data.

With all information ingested and controlled within a single platform, team members can generate reports 24/7, no matter their time zone, removing dependencies on finance and portfolio management teams. Push‑button access replaces spreadsheet bottlenecks, allowing lean IR functions to retrieve accurate, up‑to‑date numbers independently and immediately.

2. More time for value-added activities.

Because validated data flows from the platform to reporting, IR can begin crafting narratives as soon as preliminary numbers land, days or weeks earlier than before. Final NAVs or valuation tweaks refresh in‑platform, eliminating last‑minute spreadsheet scrambles.

The result: IR teams spend their energy refining insights, shaping the story, and answering the “why, how, and what‑if” questions investors now expect, instead of reconciling figures.

3. Turn LP queries in hours, not days.

Speed is the real test of a good process. When all the numbers live in one controlled platform – and the calculations are baked in – you can pull the exact figure every time and trust it. That means ad hoc questions don’t trigger a scramble across finance and IR. You just hit “run,” drop the output into Power BI, and send it on. Same source, same methodology, no risk that one person does it one way and someone else another. LPs get a fast, clean answer.

4. Bandwidth for open-ended questions like “why, how, and what‑if”.

Investor questions have shifted from straightforward metrics to broader “why, how, and what‑if” discussions – macro‑economics, risk scenarios, portfolio resilience. A data platform handles the black‑and‑white numbers, freeing you to focus on the grey. Because the figures are already trusted and up to date, the team can dive straight into analysis: pulling context, drafting commentary, shaping the narrative.

No silver bullet writes those paragraphs for you. Still, with the low-value tasks automated, you finally have the time and headspace to answer the nuanced, value‑add questions that truly differentiate an IR function.

5. Say “yes” to every bespoke request.

LPs increasingly demand their own report template. There is no reason to decline this bespoke request with a data platform. Firms only need to build the template once, with tools like Power BI or Tableau, and then it’s served from one controlled data source without extra effort throughout the years.

Get ready before your next fundraise with ATLAS Track Record.

The leading firms use Holland Mountain’s ATLAS Track Record to give fundraising and investor servicing teams access to the data they need in real time.

Implemented in 2 to 3 months, ATLAS Track Record is ready for your next fundraise, so your IR team can spend time selling rather than doing low-value tasks.

Discover ATLAS Track Record and schedule a demo with our team to see it in action.