2025 marked an inflection point for digitalization across Private Capital. The combination of a more challenging macroeconomic environment and rapid technological advancement has prompted firms to take bolder steps in their operational strategies.

This year, Holland Mountain partnered with a record number of Private Capital firms on Operational Strategy projects, designed to accelerate their operational goals and digital maturity.

During an Operational Strategy Review, Holland Mountain meets with each business function and compiles detailed findings and recommendations, drawn together in a Target Operating Model and an Operational Roadmap that outlines how the firm can best achieve its goals over the next 1-2 years.

Based on the latest Operational Strategy Reviews with our largest and most advanced clients, Holland Mountain’s Jeremy Hocter shares the major trends we anticipate for 2026.

If you are a Holland Mountain client and want to discuss one of these trends with us, contact your account manager for a call. For Private Capital firms we have not yet partnered with, feel free to contact us to continue the discussion with our experts.

Jump to trends:

- Investor Experience

- The Drive Toward Faster, More Frequent Data Access

- Benchmark Your Fund Administrator

- Data warehouse alone is not enough

- Business awareness of data, it is not an IT problem anymore.

- Huge Emergence of AI Solutions

- Divergence in the Fund Administration Market

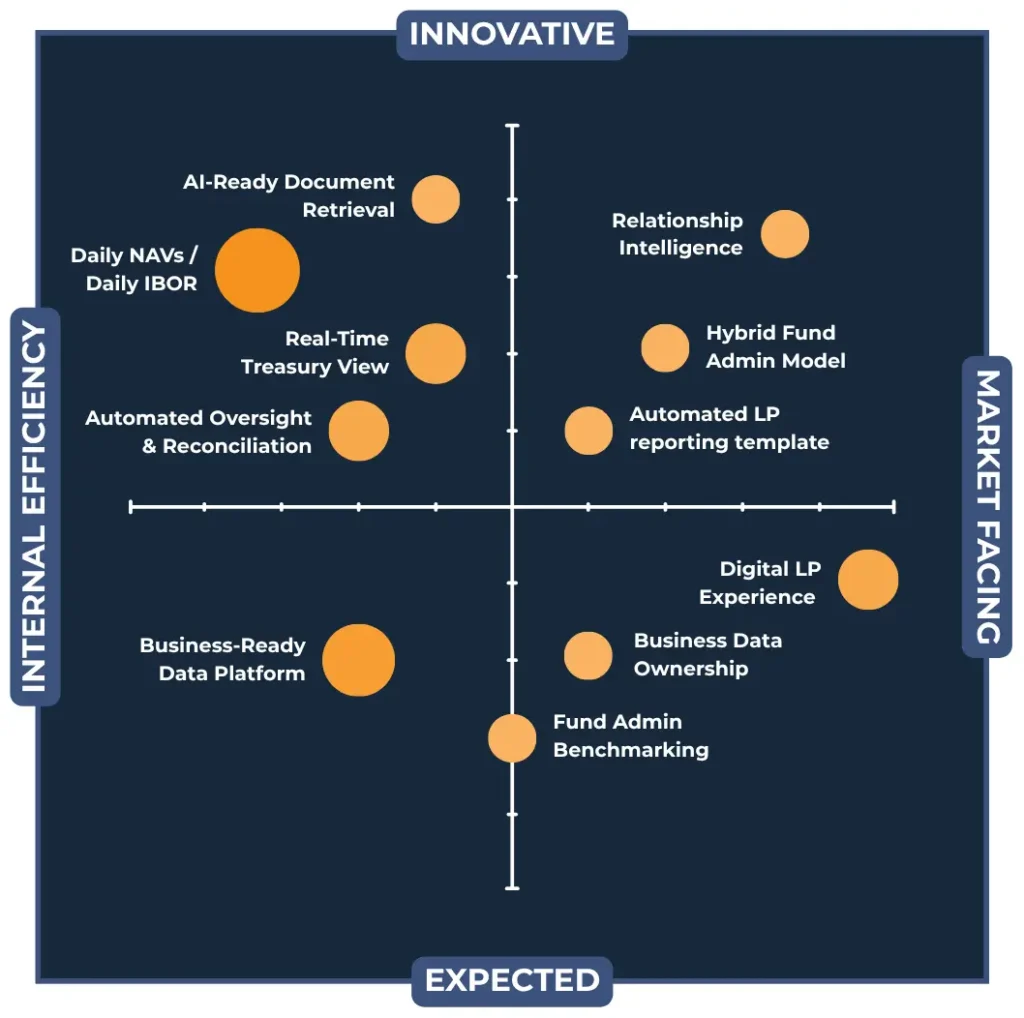

Operational Projects Landscape 2026

Download this content as a report with vendor maps in high resolution →

Theme 1: Investor Experience

Investor experience became a major focus area in 2025.

The technology to deliver a seamless LP experience is finally there. Solutions are much more mature, integrated, and capable of supporting what investor relations teams have wanted all along.

Download the map in high resolution →

We’re seeing strong uptake across our clients, with rapid innovation from both established providers and new entrants in areas such as onboarding, investor portals, and reporting.

This momentum is partly driven by growing LP expectations.

As more GPs adopt modern investor technology, the bar is rising fast – LPs now expect real-time insights and a user experience that is close to what they experience in other parts of financial services. Meeting these expectations has become essential to staying competitive.

At the same time, the investor experience story isn’t just user experience. It’s also about internal efficiency, so teams can fundraise and service investors at scale.

By automating manual investor servicing processes, IR teams can spend less time managing data and documents and more time telling the story of the fund, deepening relationships, and shaping the narrative with investors.

Key areas of focus for 2026 will be around:

- Designing a modern investor experience strategy and roadmap

- Building a modern tech stack that delivers a seamless, end-to-end investor experience.

- Automating low-value tasks to improve internal efficiency and free up time to focus on LP relationships.

- Lay the foundation to reach new and diverse investor pools, including emerging wealth channels.

(All of these initiatives can be supported by Holland Mountain. Contact us at info@hollandmountain.com for an introduction call.)

Theme 2: The Drive Toward Faster, More Frequent Data Access

Private capital firms are looking to access data faster and more frequently.

The traditional quarterly reporting cycle is no longer sufficient, particularly as new fund structures such as evergreen and interval funds gain traction.

These models introduce ongoing liquidity considerations that demand real-time visibility across fund administration, treasury, investor relations, and portfolio management functions.

We are already seeing this shift take shape. For example, in private credit, firms are moving from quarterly to monthly cycles. Large managers are also beginning to explore the feasibility of near real-time insights – although we are not there yet – recognizing that the future operating model must support continuous rather than retrospective data access.

(Preparing the business for achieving daily data updates has been growing demand among our large clients, please contact info@hollandmountain.com to learn more).

Achieving this in 2026 means

- Moving away from manual workarounds and eliminating shadow bookkeeping, which often slows down reporting and creates unnecessary duplication of data and effort.

- Looking at establishing a daily IBOR – a continuously updated investment book of records that provides an accurate picture of fund positions and cash flow throughout the month, not just at period-end.

- Reviewing treasury processes and tools to achieve a close to real-time view of cash positions, which enables better management of subscriptions, redemptions, and liquidity planning.

The objective is clear: enable faster access to run more agile, responsive operations fit for the next generation of private capital funds.

Theme 3: Benchmark Your Fund Administrator

As firms expand into new and more complex fund structures, many are realizing that their fund administrators aren’t as well-matched to their needs as they once were.

Choosing an administrator is often a decision made years earlier, under very different circumstances. But as the operational requirements of products evolve – whether through evergreen structures, interval funds, hybrid funds, or enhanced investor reporting – the technology and service model of the admin can quickly become a constraint.

Throughout 2025, Holland Mountain has worked with numerous fund managers to remediate and benchmark their relationships with administrators – not only on cost, but also on scope of services and capabilities.

The question is no longer simply “Are we getting a good deal?” but rather, “Are we using the right tools, the full functionality available, and a provider capable of supporting next-generation products?”

For firms that haven’t yet reviewed these relationships, 2026 is the time to do so.

Key discussion areas include:

- Outsourcing scope and SLAs

- Technology capabilities

- Delivery and service model

- Commercial arrangements

These are all areas where a partner like Holland Mountain can help benchmark what good looks like and share what is expected in 2026.

In a market moving toward faster data and more frequent valuations, knowing your admin’s true capabilities has become business-critical.

(If you want to know how Holland Mountain conducts fund admin benchmarking, contact your account manager or via info@hollandmountain.com)

Theme 4: A data warehouse alone is not enough

Across the industry, there’s growing recognition that a data warehouse is not the same as a data platform. From an IT perspective, a warehouse such as Snowflake or Microsoft Fabric provides the infrastructure – the nuts and bolts of moving data into a lake and organizing it through the medallion layers . But for the business teams, that’s just the starting point.

What firms actually need are the applications and data management layers that sit above the warehouse: the tools that master, validate, reconcile, and enrich data so it becomes reliable and usable. We’re seeing many managers build their warehouse and then face a new challenge – having to choose additional solutions for master data management, oversight, and reconciliation.

The industry is realizing that true data platforms deliver business-ready tools, not just storage.

Solutions like fund admin oversight, reconciliation, or carry and co-investment management are effectively software applications built on top of the data foundation. They’re what transform data infrastructure into business capability – and they’re what truly differentiate a complete platform from a warehouse alone.

Theme 5: Business awareness of data, not an IT problem anymore

Data strategy is no longer viewed as a purely technical issue – it’s now firmly on the business agenda. What was once led by IT is increasingly being driven by COOs, CFOs, and investment teams who recognize that data underpins everything from reporting to decision-making.

Several factors are accelerating this shift.

- Firms are recognizing that moving between systems is complex precisely because all their data lives in many places.

- Multi-admin models and fund restructures are exposing gaps in data ownership and consistency.

- As AI becomes a larger part of the conversation, the business value of clean, accessible data has never been clearer.

The result is a growing focus on centralized data platforms, data governance roles to control data in source systems, and treating information as a true strategic asset.

Data is no longer a back-office consideration – it’s become a core enabler of business agility and innovation.

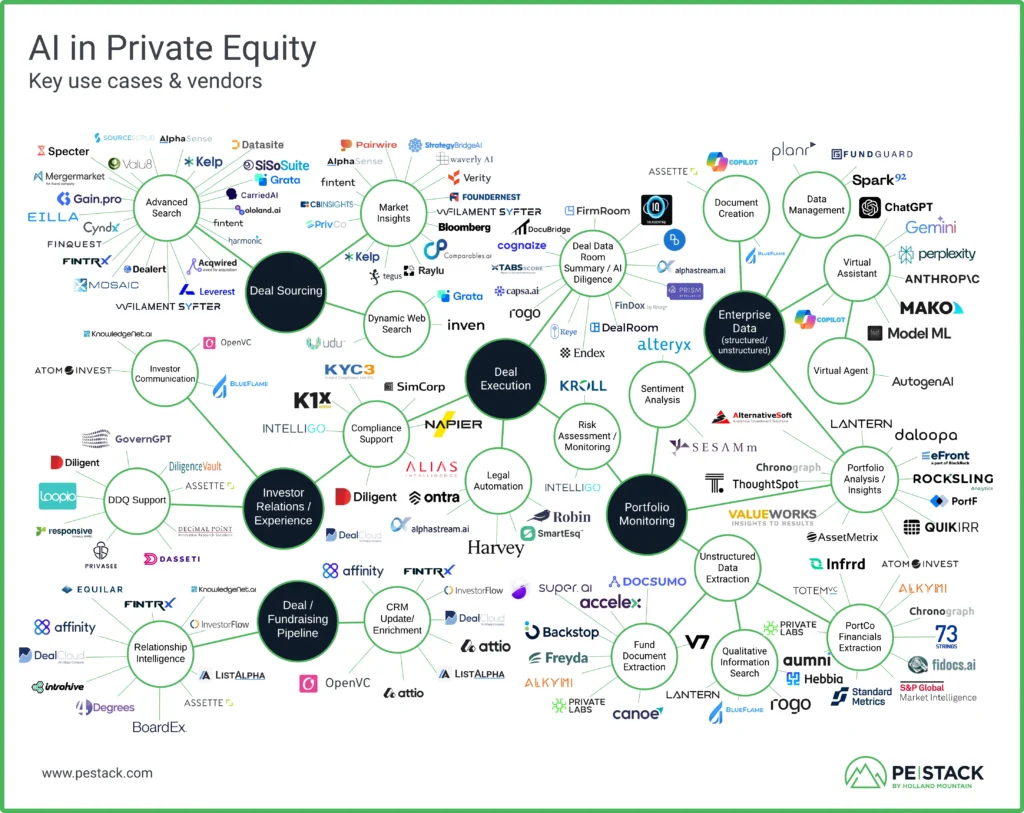

Theme 6: Huge Emergence of AI Solutions

This year, we’ve seen a huge emergence of AI point solutions across the private capital industry. Some are standalone applications focused on very specific use cases, while others are established systems such as CRM or portfolio management tools, embedding AI functionality.

With PE Stack, we identified over 100 AI tools in 2025, and there are surely more emerging each month .

This surge made it highly overwhelming for managers to decide which solution to go for (an area Holland Mountain is helping a lot, please contact us to learn more).

Download the map in high resolution →

Some key takeaways to keep in mind as we head into 2026

In 2025, most managers have centred efforts around the adoption of horizontal AI applications such as Copilot, ChatGPT, and Claude, with only a smaller proportion implementing specialised AI tooling.

- In 2026, we can expect deeper investment in AI verticals targeting specific use cases, such as AI to support deal sourcing, enhance the speed and quality of Investment DD, and support the automation of operational activities (e.g. DDQs).

- There is also a growing appetite to build custom solutions in areas where the market is not yet providing off-the-shelf tools.

- Whilst growth in AI adoption has many benefits, firms are also starting to see duplicated effort and spend: overlapping technologies, siloed prompt and agent creation, and limited internal knowledge sharing. As a result, many will start revisiting their AI governance frameworks to encourage more coordinated, efficient, and effective use of AI.

In parallel with the rapid growth of AI solutions, there’s been a noticeable shift in focus toward documents.

Many firms have realized that it’s challenging to find the documents to feed to the language model for informed decision-making. This has prompted teams to spend time cleaning, tagging, and organizing files across SharePoint and other repositories, so that AI tools can actually locate and interpret the correct, up-to-date information.

It’s also worth noting that AI solutions now exist that can automatically handle meta-tagging and classification.

The conversation around AI has therefore become more practical and will continue to do so in 2026. Rather than abstract promises, firms are now focusing on how to make these point solutions work effectively for their environment and use cases.

Theme 7: Divergence in the Fund Administration Market

This year, we’ve seen a clear divergence emerging among fund administrators.

As fund structures become more complex and managers launch hybrid products, the operational requirements placed on administrators are becoming increasingly bespoke.

Traditional players – often constrained by legacy systems and rigid models – are struggling to adapt, while a new generation of agile administrators is beginning to stand out.

New entrants are thinking about data first, building modern, flexible operating and technology models designed to support complex, multi-asset requirements.

They combine multiple systems with a unified data layer and robust data mastering, giving clients a single, coherent environment instead of fragmented point solutions.

This divergence is set to widen, and at Holland Mountain, we are tracking these developments closely in our Fund Admin Datahub.

What does that mean for Private Capital firms in 2026?

- A new generation of fund administrators is entering the market. If you’re considering a change – or have only experienced one type of provider – these emerging players are worth a closer look.

- For managers with complex or hybrid products, these innovative admins may offer the agility and data integration needed to improve efficiency and achieve fund objectives.

Holland Mountain: Your Partner for 2026

Want to discuss these trends in more detail?

- Contact your account manager for a discussion, or schedule an introductory call by clicking here.

Our services for Private Capital firms:

- Advisory: From operational strategy design and investor experience to outsourcing strategy and tech implementation, our Private Capital specialists can support your operational goals in 2026.

- Data solution: Holland Mountain’s ATLAS data platform is designed to meet all the data requirements and evolving needs of Private Capital firms.